Advanced Research limited (a fictional company) is the UK incorporated and UK tax resident technology company focusing on manufacturing and retail of STEM educational toys for children. Company has been conducting research

BAM7006 International Management in Finance and Accounting CW1 Report Assignment Brief | BNU

BAM7006 Assignment task

Case Study Background:

Advanced Research limited (a fictional company) is the UK incorporated and UK tax resident technology company focusing on manufacturing and retail of STEM educational toys for children. Company has been conducting research and development of educational toys and now needs to make the decision whether to launch the product.

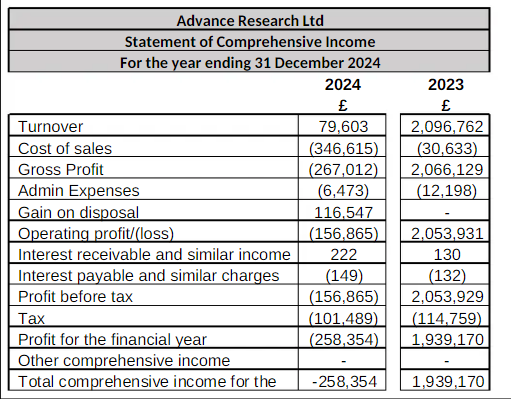

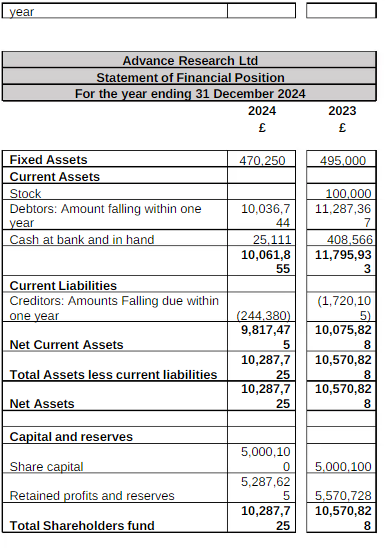

Advance research limited has done very well in financial year 2023 but has seen a sharp decrease in revenues in the year 2024. Company’s financial statements are given below:

You are a business manager responsible for the launch of this product and the production manager asked you to prepare report to satisfy this investment in new product

You have been given the information to consider about the various departments within the company.

R&D Team

“We have spent substantial amount on this project which is £450,000 and it would be a shame if it doesn’t get through to the market (said CFO)”. It is estimated that we may need to spend another £80,000 to get to the position where the product is ready for the launch.

Do You Need CW1 of BAM7006 Report

Order Non Plagiarized Assignment

The production department

I have looked into the production and there is need to purchase a new equipment that is capable to manufacture on the scale of demand which will cost £1,800,000. The company has excess labour capacity Which will run the new machine, but it is estimated that a new specialist supervisor required. The instructions are sent to HR for the recruitment of a specialist supervisor and to stablish the salary and benefits for the post.

Marketing

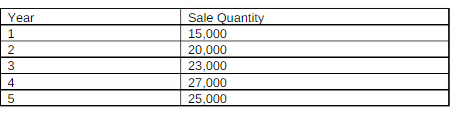

there is some research that suggests potential pricing for this product and likely customer targets, these pricing is still under consideration. Estimates indicate that selling price would be £90 per toy in first year of operation, increased by £5 per year. The cost of material estimates to be 45% of the domestic selling price and the selling department has given the following projections for the first five years.

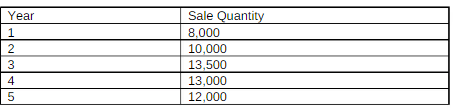

Company presented product in a recent event at London ExCel, the product has attracted international buyers. The interest from the international buyers have shown about 50% equal and to the national sales. These numbers can be quantified as:

After five years, it is estimated that the technology would advance beyond this point and the product will no longer be attractive. It is assumed that the life of this project will probably mature unless a new investment is made with a constant innovation in the product.

It is estimated that the marketing campaign will cost £300,000 in the year 1 to kickstart the project and these costs projected to stay the same for year 2 and 3. Estimates suggest cost will fall any year 4 and 5 £200,000 a year.

The confirmation from the HR shown the salary and benefits or the supervisor will it start from £45,000 a year within annual increase of 5%. Insurance costs

Investigation has revealed appropriate cost of capital with following information:

The market value of share is £3.00 per share and there are 6,000,000 ordinary shares in issue. Expected to continue 60 pence per share for the foreseeable future.

Company has £12 million irredeemable loan capital with an interest rate of 6% and is currently quoted at £90 per £100. The corporation tax rate is 20%

Business has previously been using an estimated weighted average cost of capital of 20% and management team would like to see the calculation also based on using WACC that was calculated as an original estimate of 20%.

Required:

You are required to prepare a business plan feed into business report to be presented to Chief Financial Officer which comprising existing business position and the viability of the product in discussion. The non- executive directors on the board do not have a strong financial background are very much interested in the techniques that are used to appraise investment with a comprehensive explanation of how to come your conclusion and explanations support this idea.

3000 Word Report Structure Guidelines:

1. Executive summery

2. Calculate profitability and liquidity ratios from financial statements and analyse year on year company performance.

3. Calculate projected cash flow up to project life including national and international demand. 4. Evaluate cost of capital including:

a. Weighted average cost of capital (WACC)

b. Uses of WACC

c. Workings for WACC (cost of equity, cost of debt then weighting to get WACC)

5. Evaluate and critically review investment by:

a. Evaluate essence of NPV for invest appraisal

b. Appraise the project by calculate NPV for the project using WACC

c. Calculate NPV using cost of capital of 20%

d. Board is interested to see payback period for the project

e. Review the results and provide justification to the make the informed decision

6. Board members having non-financial knowledge would like to know about the comparison of cost elements (variable and fixed) associated with this project.

Evaluate the sources of funds to support overseas expansion for which directors have shown

interest in business expansion overseas but facing a shortage of finance.

Your report should be completed using outlined structure for the report.

- A cover sheet

- An executive summary

- A table of contents

- Introduction

- Task

- Conclusion

- Harvard Reference List

- Appendices-detailed calculations

Learning Outcomes of BAM7006:

LO 1 Critically review the methods available to a company to establish itself and trade successfully in the international market

LO 2 Evaluate the financial instruments used by multinational corporations to minimise risk and maximise shareholder returns.

LO 3 Critically evaluate international business issues from a financial management

perspective.

LO 4 Analyse the effectiveness and the role of uniform financial reporting requirements in the internationalisation process