IAB401: Enterprise Systems Assessment Part A Assignment Brief: Service Delive ry for Social Welf are Support in Australia through the Departmen t of Human Serv i ces 1. Overview: Social welfare support through Services

IAB401 Enterprise Architecture Enterprise Systems Part A Assignment Brief | QUT

IAB401: Enterprise Systems Assessment Part A

Assignment Brief: Service Delive ry for Social Welf are Support in Australia through the Departmen t of Human Serv i ces

1. Overview:

Social welfare support through Services Australia Governments worldwide provide social welfare through payments and services to support individuals, families, and other groups in particular circumstances that limit their ability to support themselves. Social welfare support includes unemployment benefits, study assistance, rental assistance, disability insurance, and childcare support.

Customer requests must be carefully assessed to determine the appropriate payments and services, depending on specific conditions and the nature of the request, e.g., income level, number of dependents (such as spouse and children), and overall health status.

1.1. About the Department of Health Services

In Australia, social welfare services are available for citizens through the federal government’s Services Australia department (hereafter referred to as ‘the department’) under the Social Security Act 1999, Social Security Admin Act 1999, and New Tax System Family Administration Act 1999, which were passed through the federal parliament. The department comprises several agencies, including Centrelink, Medicare, and Child Support, and is responsible for different areas of social welfare support.

The services provided by the department from its agencies include:

- Payments (e.g., Youth Allowance providing financial support for those under 24, Austudy for study support, and job seeker payment providing financial support for those out of work and over 22)

- Concessions (e.g., discounts for travel and groceries)

- Other forms of services (e.g., health support).

The department is responsible for providing payments and services, which means that it designs, develops, delivers, and monitors their usage.

1.2. Overview of the Department’s Service Delivery

The department is mandated to provide services that can be easily comprehended by customers (i.e., what services are available, who can apply, what the rules for accessing them are, how to apply, etc.). This is a significant factor in improving the efficiency and effectiveness of service delivery, as customers often have uncertainties about what support is available for them. There is an extremely high volume of customer interactions and processing steps for the services involved.

The following figures, drawn from historical data in the past, provide insights into the size and scale of service delivery required from the department:

- Around 720 million digital and online transactions a year (i.e., payments made to customers)

- Around 21 million visits from customers at its 350 service centres per year

- Around 169 billion dollars in payments to customers and providers

- Around 56 million phone calls per year.

Customers can access payments and services via a range of the department’s online, postal and staff-assisted channels (e.g., website, mobile applications and service centres). Payments and services are also accessed through external agencies or delivery partners responsible for supporting customer needs (see below in this section). The department’s website provides full details of all the available online services. An impression of the customer segments related to payments and services is provided in Figure 1.

Figure 1: Impression of customer segments for DHS (Services Australia)

For customer convenience when accessing services with the federal government, the department’s services may also be accessed online through the federal government’s myGov service centres and myGov website. MyGov provides ‘one-stop-shop’ access to different government agency services, including those offered by the department.

As stated above, the department utilises several external agencies, or Delivery Partners, to support it in certain aspects of delivery. The delivery partners assist customers in their circumstances, helping them address these issues. An example of delivery partners includes agencies focused on job placement (i.e., Job Active Providers), which assist customers in finding work and securing jobs. In this case, unemployed customers seek assistance through the department for unemployment benefits (e.g., through Newstart Allowance for those who are over 22 years old and under the pension age of 65-67 years old) and utilise a ‘jobactive organisation’ as a delivery partner to find work and report on progress in terms of job seeking or any required training as part of the agreement to get unemployment benefits (called mutual obligation). Customers may also trigger claims for services through delivery partners, which the partners forward to the department.

The department interacts with other Customer Stakeholders to obtain information about customers, to verify the identity of customers and their circumstances, and to make decisions about providing payments and services. Stakeholders include education institutions for the study being undertaken, employers where customers work, real estate for property related to customers’ residence or investments, financial institutions where customers manage their money or investments, and other government departments that have customers in their records (e.g., the Australian Tax Office has information about taxpayers).

The department interacts with Policy Agencies and Service Owners because it provides social welfare and related services, not an owner or policy-setting agency of the services. Other agencies are responsible for the policy and service ownership of the department’s payments and services. Specifically, the Australian Federal Parliament and other Australian State and Local parliaments pass laws that impact the kinds of service payments delivered by the department. Policies provide regulatory rules for payments and services, i.e., rules for assessing these, citizens’ obligations when granted, and penalties that could apply (e.g., related welfare fraud). Policy Agencies and Service Owners interact with the department to convert policy, new payments, business rules, etc., into business processes. The impact of new policy settings on existing processes needs to be carefully understood, and change plans must be implemented. Other Policy Agencies and Service Owners are Queensland’s Department of Energy and Public Works, where services provided by the Queensland Government might impact services provided by the department (e.g., if a customer needs housing assistance support, there should be a clear understanding about which agencies they should apply to – e.g., Department of Energy and Public Works.

Stuck Your IAB401 Assignment? Deadlines Are Near?

Hire Assignment Helper Now!

2. Organisational structure

The department’s organisational chart provides an insight into the key actors and business capabilities that support its charter. A simplified summary of the key areas1 of the organisation is as follows:

- Service Delivery Operations: This area covers customer service delivery management across channels and core business processes and systems. It involves the following:

– Planning for business areas and departmental channels to ensure the right resources are available to deliver payments and services.

o Service delivery processes begin with customers registering to obtain a customer profile (record).

o Discovery of payments and services for specific needs and personal circumstances.

o Assessing eligibility for services (whether customers can receive services given their circumstances, such as the income and assets they have)

o Assessing entitlement for services (determining how much customers are entitled to receive given their circumstances)

o Setting up services (e.g., setting up payments for fortnightly transfers to customers)

o Running/managing the services over the time that they have been set up to deliver also involves interactions with the delivery partner for assisted services delivery.

- Payments Reform (Transformation): This area involves planning, design, and implementation of key systems that introduce new ways of undertaking service delivery. The teams in this area undertake ‘future state’ business strategy, business architecture, solution architecture, and solution implementation (including solution procurement from the market).

- Integrity and Information: This area is involved in analysing data generated through service delivery to manage:

o Fraud (when payments are either claimed or made for customers reporting false circumstances)

o Compliance (to determine that customers are providing timely and accurate information and following the right processes for receiving services)

o Debt resulting from when customers should not have received full or partial payment. - Corporate and Financial Services: This area is responsible for the internal processes and systems supporting the department’s management.

This includes:

o Human resources management (i.e., management of staff)

o Financials (accounting)

o Product management (procurements and fulfilments)

o Vendor management covers engagement, funding, and tracking of product suppliers (e.g., for office equipment), delivery partners (for assistance in service delivery), and other service providers (e.g., for engagement of property services such as cleaning).

- Chief Information Officer (CIO) Group: providing IT management for all the IT systems used by the department. This involves supporting various systems, including software applications, software platforms (e.g., database systems, operating systems) and systems infrastructure (hardware). It covers planning, design, implementation and running of IT systems. Note, for designing and implementing systems, the CIO group works closely with the Payments Reform (Transformation) area, which, as described above, is responsible for running projects that introduce key systems to the department.

3. Service deliver y busines s and IT s ystems

The department provides payments and services through several government agencies. Centrelink is one of the largest, providing payment and support services to customer segments such as job seekers, seniors (no longer working full-time), students and trainees, families, carers, parents, people with disabilities, Indigenous Australians, and people from culturally and linguistically diverse backgrounds.

To deliver services, the department uses a range of customer management, claims lodgement, claims assessment, and service payment capabilities to deliver customer outcomes, as utilised through the Service Delivery Operations organisational area.

3.1. Customer needs, registration and service matching

Customers digitally access services through the department’s website, interactive kiosks, and mobile applications. The staff-assisted channels comprise service centres in various towns and cities nationwide, an integrated call centre with locations across different cities, postal mail processing in service centres, and mobile service centres (trucks) serving regional communities.

3.1.1 Online interactions

Suppose a customer wishes to lodge a claim for support online. In that case, they first access the myGov portal, which is the federal government’s ‘one-stop-shop’ entity from which services of the federal government are meant to be accessed. To claim social welfare, customers will need a Centrelink online account, which is linked to their Customer Profile (Record) identified by a Customer Reference Number. With a profile in place, a customer can sign in to their account from myGov and connect to Centrelink (and other agencies) to gain access to services. If customers do not have an account or customer profile, they will have to visit a service centre to be identified and provide documents to identify themselves (e.g. driver’s licence, birth certificate). The department will issue a profile and account once customers are accurately identified.

A claim form for payments and other services can be filled in online2. This form is used as the basis to verify customer details in relation to their requests, perform assessments for eligibility (checking conditions that customers should satisfy to receive one or more payments/services) and entitlement (how much of one or more payments/services can be supported).

A customer will be requested to provide all relevant details (as outlined by legislation policy and associated business rules). The claim form will include customer information relevant to themselves and their claims – i.e. Customer Reference Number, their names, identities (like Tax File Number created through the Australian Tax Office), details of their dependents (e.g. spouse and children), and other circumstances. Circumstances include the details of income customers earn, savings, assets such as cars and houses owned, courses they are studying, etc.

For specifying their welfare support requirements, the customer nominates several payments and services available through the department for their needs. A digital service called Payment Finder is available for customers to find payments and services relevant to their needs, to do a self-assessment about whether they are eligible for the service, and to simulate how much they are entitled to (Payment and Services Finder).

In some instances, information about a customer’s circumstances and other details is held in systems of other agencies or Customer Stakeholders. This may include information about their tax records, family members, courses studied, health care, jobs, etc. This information may be requested via the customer or through the department to Customer Stakeholders using an automated data exchange system (for further details, see section 4).

Certain aspects of making a claim may require sending in information. For example, claims-related documents can be sent to the department via scan/upload using a document lodgement service. The customer is also asked to verify their identification and claims. Alternatively, a customer may post or personally take documents to a service centre.

In addition to the Payment Finder, other customer services available online are customer management (including capture and update of identity and circumstance details), claims management (including claims lodgement, assessment, enquiries and tracking), document lodgement, and customer feedback (related to the input they provide the department for service delivery).

3.1.2 Staff-assisted interactions.

In many instances, details of claim forms cannot be completed online, and staff-assisted processes are required. Customers may then be directed to provide further information at a service centre or by telephone at a call centre. Customers identify themselves via a service centre or by phone. In addition, they may provide updates about their circumstances, including existing payments and services they receive, such as changes to their address or part-time work. These are called staff-assisted interactions.

Customers who attend a service centre will be ‘triaged’ on arrival by a Customer Liaison Officer to determine which Customer Service Officer (i.e., staff at the service centre) is best suited to assist them. This could be a generalist officer or a specialist, such as a social worker.

Once triaged, the Customer will be directed to the next interaction step. In some cases, this may be immediate, and in other cases, there may be a wait period before a required officer is available. In other instances, an appointment will be booked at a future time for a telephone or service centre meeting with the customer to obtain and validate more complex details about the customer’s circumstances and social welfare needs.

In extreme cases, specialist social workers are assigned to assist customers in determining special needs and planning to assist them. An example of where a social worker is needed is where a customer may be homeless or has experienced domestic violence. In such examples, while running through the process of applying for a claim is important, the department recognises that customers are experiencing personal stress and other factors and need proper social care and follow-up when applying for payments/services.

4. IT systems used

- The myGov agency has a ‘One-Stop-Shop’ System supporting:

• The myGov portal

• Secure Gateway, which supports communications between myGov and other agency applications that it provides access to (currently the department and the Australian Tax Office) - The department has an integrated online web application to support its website, a mobile application, and a kiosk application to support its online channels.

- The department has a Customer Relationship Management system that holds the accounts and profiles of its registered customers (uniquely identified by a Customer Registration Number). This system holds details of customers, such as their circumstances and data obtained from Customer stakeholders (e.g. Tax File Number, QUT Student ID). It also has details of customer payments/services accessed currently and in the past.

- The department has a Service Management System supporting:

• Claims Management manages the capture, update and tracking of claims made by customers.

• Service Management manages the service offers, by way of payment(s) and service(s) over a time period that customers access, the obligations that are put in place, and interactions that take place regarding services—payments/services delivered, reports made by customers to update their circumstances. - The department has a Payment Engine that supports customer payments and debts.

- The department has a Secure Partner Gateway for data exchange with Customers.

- Stakeholders, Delivery Partners and outside agencies. § Enterprise Resource Planning system used for production management.

5. Tasks

For details of the assignment tasks, please read the following and also refer to the Assignment Coversheet part of the document (above), in the section covering “Tasks & Marks”.

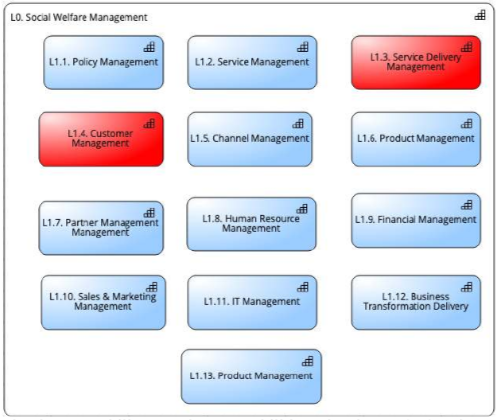

I. Develop a multi-level business capability and related value stream based on the “Assignment Brief” above. This will involve developing the Service Delivery Management and Customer Management Capabilities. A background of these capabilities is provided above (sections 2, 3 and 4). As the overriding context, the high-level business capabilities (levels 0 and 1) are provided as follows. The Service Delivery Management and Customer Management.

The above capability map shows capabilities at levels zero (L0) and one (L1). You are to develop levels 2 and 3 of each capability highlighted in red: Service Delivery Management & Customer Management. Note that the highlighted capabilities are already at level 1; you will need to develop levels two (L2) and three (L3) for both capabilities.

As part of this exercise, the missing capability will need a graphical business capability model and a textual description of each capability. All assumptions made will also need to be briefly described.